Annual Financial Report

30th Apr 2025 11:00

FOR FULL REPORT PLEASE VISIT WWW.EXIM.HU

Hungarian Export-Import Bank Private Limited Company and its subsidiary

Consolidated financial statements

based on IFRS standards adopted by the EU

31 December 2024

Contents

Page

Consolidated financial statements: 3

Statement of Financial Position as at 31 December 2024 3

Statement of Comprehensive Income as at 31 December 2024 4

Statement of Changes in Shareholders' Equity as at 31 December 2024 5

Cash Flow Statement as at 31 December 2024 7

Notes to the financial statements: 9

Note 1 | General information | 9 |

Note 2 | Principles of compilation | 10 |

Note 3 | Significant accounting policies | 12 |

Note 4 | Cash and cash equivalents | 35 |

Note 5 | Derivatives | 35 |

Note 6 | Government securities measured at amortised cost | 49 |

Note 7 | Loans and advances to credit institutions and insurance companies | 50 |

Note 8 | Loans and advances to other customers | 52 |

Note 9 | Investments measured at fair value through profit or loss | 53 |

Note 10 | Investments accounted for using the equity method | 58 |

Note 11 | Intangible assets | 66 |

Note 12 | Property, plant and equipment | 68 |

Note 13 | Taxation | 71 |

Note 14 | Other assets | 73 |

Note 15 | Provisions and impairment | 74 |

Note 16 | Liabilities to credit institutions and insurance companies | 76 |

Note 17 | Liabilities to other customers | 76 |

Note 18 | Bond issue | 77 |

Note 19 | Other liabilities | 83 |

Note 20 | Shareholders' Equity | 83 |

Note 21 | Credit lines, promissory notes and contingent liabilities | 85 |

Note 22 | Interest income and interest expense | 87 |

Note 23 | Net income from fees and commissions | 89 |

Note 24 | Gains or losses on derecognition of financial assets measured at amortised cost |

91 |

Note 25 | Gains or losses from trading and investment activities | 91 |

Note 26 | Other operating income and expenses, personnel-type expenditures, depreciation and amortisation |

92 |

Note 27 | Maturity analysis of assets and liabilities | 93 |

Note 28 | Related party transactions | 95 |

Note 29 | Financial assets and liabilities by undiscounted residual cash flows |

101 |

Note 30 | Financial risk analysis | 106 |

Note 31 | Geographical information | 141 |

Note 32 | Events after the balance sheet preparation date | 146 |

Note 33 | Use of estimates and judgements | 147 |

Note 34 | Fair value of financial instruments | 149 |

Statement of consolidated financial position

31 December 2024

HUF million | Note | 31.12.2024 | 31.12.2023 |

Cash and cash equivalents | 4 | 362 092 | 965 591 |

Derivative transactions - Held for trading, measured at fair value through profit or loss | 5 | 558 | 900 |

Derivatives held for hedging purposes | 5 | 27 669 | 3 523 |

Securities measured at amortised cost | 6 | 347 169 | 149 145 |

Loans and advances to credit institutions and insurance companies | 7 | 1 481 048 | 1 528 308 |

Loans and advances to other customers | 8 | 1 611 783 | 860 644 |

Investments measured at fair value through profit or loss | 9 | 36 578 | 32 824 |

Investments accounted for using the equity method | 10 | 93 044 | 94 444 |

Intangible assets | 11 | 2 439 | 2 183 |

Property, plant and equipment | 12 | 2 157 | 1 636 |

Actual income tax receivables | 13 | 781 | - |

Other tax receivables | 13 | 446 | 428 |

Deferred tax receivables | 13 | 206 | 193 |

Other assets | 14 | 1 242 | 2 410 |

Total assets |

| 3 967 212 | 3 642 229 |

Derivative transactions - Held for trading, measured at fair value through profit or loss | 5 | 2 373 | - |

Derivatives held for hedging purposes | 5 | 39 768 | 21 167 |

Liabilities to credit institutions and insurance companies | 16 | 1 309 715 | 1 185 600 |

Liabilities to other customers | 17 | 3 819 | 10 514 |

Securities issued | 18 | 2 142 543 | 1 994 599 |

Provisions | 15 | 1 204 | 1 934 |

Actual income tax liabilities | 13 | 635 | 2 246 |

Other tax liabilities | 13 | 326 | 236 |

Other liabilities | 19 | 5 452 | 6 973 |

Total liabilities |

| 3 505 835 | 3 223 269 |

Subscribed capital | 20 | 364 345 | 340 000 |

Retained earnings | 20 | 59 890 | 63 552 |

Other reserves | 20 | 37 142 | 15 408 |

Total equity |

| 461 377 | 418 960 |

Total equity and liabilities |

| 3 967 212 | 3 642 229 |

15 April 2025

Authorised for issue by:

Kornél Kisgergely Sándor Ladányi

Chairman and Chief Executive Officer Chief Financial Officer

Statement of Consolidated Comprehensive Income

31 December 2024

HUF million | Note | 2024 | 2023 |

Interest income recognised using the effective interest method | 22 | 244 408 | 262 420 |

Other interest income | 22 | 79 524 | 50 169 |

Interest expense recognised using the effective interest method | 22 | (195 359) | (206 244) |

Other interest expense | 22 | (73 508) | (45 346) |

Net interest income/loss |

| 55 065 | 60 999 |

Fee and commission income | 23 | 791 | 943 |

Fee and commission expense | 23 | (427) | (325) |

Net income from fees and commissions |

| 364 | 618 |

Gains or losses on derecognition of financial assets measured at amortised cost | 24 | (266) | (25) |

Impairment losses on financial instruments and (creation)/reversal of provisions | 15 | (7 868) | (16 342) |

Impairment (losses) or reversal of impairment on non-financial assets | 15 | (26) | (59) |

Gains or losses from trading and investment activities | 25 | 6 367 | 10 077 |

Other operating income | 26 | 876 | 506 |

Other operating expenses | 26 | (8 042) | (7 924) |

Personnel expenses | 26 | (6 581) | (5 567) |

Depreciation | 26 | (1 216) | (1 074) |

Share of profit/(loss) of investments accounted for using the equity method | 10 | (21 250) | (18 462) |

Profit before tax |

| 17 423 | 22 747 |

Income taxes | 13 | (2 947) | (4 164) |

Profit for the year |

| 14 476 | 18 583 |

Other comprehensive income to be reclassified to profit or loss |

| 3 596 | 15 165 |

Currency translation difference on foreign currency-based associates | 10 | 3 803 | (943) |

Unrealised gains/losses on cash flow hedges - cost of hedging | 5 | (954) | 17 495 |

Unrealised gains/losses on cash flow hedges - hedging reserves | 5 | 16 161 | 6 350 |

Reclassification to profit or loss of unrealised gains/losses on cash flow hedges | 5 | (15 293) | (6 038) |

Amortisation of hedging costs to profit or loss | 5 | (142) | (106) |

Related deferred tax | 13 | 21 | (1 593) |

Other comprehensive income for the period (net) |

| 3 596 | 15 165 |

Total comprehensive income for the period |

| 18 072 | 33 748 |

15 April 2025

Authorised for issue by:

Kornél Kisgergely Sándor Ladányi

Chairman and Chief Executive Officer Chief Financial Officer

Statement of changes in consolidated equity

31 December 2024

HUF million | Subscribed capital | Capital reserve | Retained earnings | General reserve | Cost of hedging reserve | Hedge reserve | Foreign currency translation reserves | Total |

Balance as at 31 December 2023 | 340 000 | 400 | 63 552 | 15 351 | (183) | (792) | 632 | 418 960 |

Comprehensive income for the year |

| |||||||

Profit/loss for the year | - | - | 14 476 | - | - | - | - | 14 476 |

Other comprehensive income | - | - | - | |||||

Exchange differences arising on the translation of foreign currency transactions | - | - | - | - | - | - | 3 803 | 3 803 |

Unrealised gains/losses on cash flow hedges - Changes of cost of hedging | - | - | - | - | (954) | - | - | (954) |

Unrealised gains/losses on cash flow hedges - Changes of hedging reserves | - | - | - | - | - | 16 161 | - | 16 161 |

Reclassification to profit or loss of unrealised gains/losses on cash flow hedges | - | - | - | - | - | (15 293) | - | (15 293) |

Amortisation of hedging costs to profit or loss | - | - | - | - | (142) | - | - | (142) |

Related deferred tax | - | - | - | - | 99 | (78) | - | 21 |

Total comprehensive income for the year | - | - | 14 476 | - | (997) | 790 | 3 803 | 18 072 |

Other transactions recognised directly in equity |

| |||||||

Subscribed capital increase (Note 20) | 24 345 | - | - | - | - | - | - | 24 345 |

Subscribed capital decrease | - | - | - | - | - | - | - | - |

Reclassification of retained earnings to general reserve | - | - | (18 138) | 18 138 | - | - | - | - |

Total other transactions | 24 345 | - | (18 138) | 18 138 | - | - | - | 24 345 |

Balance as at 31 December 2024 | 364 345 | 400 | 59 890 | 33 489 | (1 180) | (2) | 4 435 | 461 377 |

15 April 2025

Authorised for issue by:

Kornél Kisgergely Sándor Ladányi

Chairman and Chief Executive Officer Chief Financial Officer

Statement of changes in consolidated equity

31 December 2023

HUF million | Subscribed capital | Capital reserve | Retained earnings | General reserve | Cost of hedging reserve | Hedge reserve | Foreign currency translation reserves | Total |

Balance as at 31 December 2022 | 310 000 | 400 | 48 849 | 11 471 | (17 083) | - | 1 575 | 355 212 |

Comprehensive income for the year |

| |||||||

Profit/loss for the year | - | - | 18 583 | - | - | - | - | 18 583 |

Other comprehensive income | - | - | ||||||

Exchange differences arising on the translation of foreign currency transactions | - | - | - | - | - | - | (943) | (943) |

Unrealised gains/losses on cash flow hedges - Changes of cost of hedging | - | - | - | - | 17 495 | - | - | 17 495 |

Unrealised gains/losses on cash flow hedges - Changes of hedging reserves | - | - | - | - | - | 6 350 | - | 6 350 |

Reclassification to profit or loss of unrealised gains/losses on cash flow hedges | - | - | - | - | - | (6 038) | - | (6 038) |

Amortisation of hedging costs to profit or loss | - | - | - | - | (106) | - | - | (106) |

Related deferred tax | - | - | - | - | (489) | (1 104) | - | (1 593) |

Total comprehensive income for the year | - | - | 18 583 | - | 16 900 | (792) | (943) | 33 748 |

Other transactions recognised directly in equity |

| |||||||

Subscribed capital increase | 30 000 | - | - | - | - | - | - | 30 000 |

Subscribed capital decrease | - | - | - | - | - | - | - | - |

Reclassification of retained earnings to general reserve | - | - | (3 880) | 3 880 | - | - | - | - |

Total other transactions | 30 000 | - | (3 880) | 3 880 | - | - | - | 30 000 |

Balance as at 31 December 2023 | 340 000 | 400 | 63 552 | 15 351 | (183) | (792) | 632 | 418 960 |

15 April 2025

Authorised for issue by:

Kornél Kisgergely Sándor Ladányi

Chairman and Chief Executive Officer Chief Financial Officer

Consolidated cash flow statement

31 December 2024

(All amounts in HUF million, unless stated otherwise)

Description | Note | 31.12.2024 | 31.12.2023 |

Profit for the year | 14 476 | 18 583 | |

Depreciation | 26 | 1 216 | 1 074 |

Impairment losses on assets | 15 | 15 995 | 12 966 |

(Profit)/loss from revaluation to fair value | 6 646 | 22 582 | |

Share of the profit or loss of investments accounted for using the equity method (profit + / loss -) | 10 | 21 249 | 19 404 |

Reclassification to profit or loss of unrealised gains/losses on cash flow hedges | 5 | (15 293) | (6 038) |

Changes in hedging adjustments accounted for in profit and loss | 5 | (8 865) | (7 146) |

Foreign exchange loss/(gain) on non-operating cash flows | 18 | 77 180 | 16 386 |

Changes in other assets not involving cash flow (IFRS 16) | 12 | 22 | (90) |

Net interest income | 22 | (55 065) | (60 997) |

Income tax expense | 13 | 2 947 | 4 164 |

Net change in receivables from credit institutions and insurance companies (excluding impairment) | 47 224 | (332 127) | |

Net change in receivables from other customers (excluding impairment) | (757 469) | (420 775) | |

Net change in other assets | 1 150 | 3 416 | |

Net change in receivables from credit institutions and insurance companies, except change of long-term subordinated loan that can be considered | 119 829 | 6 165 | |

Net change in liabilities to other customers | (6 814) | 7 879 | |

Net change in other liabilities and provisions | (1 612) | 431 | |

Interest received | 319 058 | 311 710 | |

Interest paid | (286 351) | (183 129) | |

Income taxes paid | (5 331) | (1 746) | |

Net cash flow from operating activities |

| (509 808) | (587 288) |

INVESTMENT ACTIVITIES |

|

|

|

Purchase of government securities and corporate bonds | 6 | (203 592) | (102 662) |

Maturity of government securities | 6 | 10 000 | 72 847 |

Subscription of investments accounted for using the equity method / asset contribution | 10 | (16 046) | (26 649) |

Investment capital reduction / yield payment accounted for using the equity method | 10 | - | 1 775 |

Investment acquisition measured at fair value through profit or loss | 34 | (1 009) | (3 254) |

Shareholdings capital reduction / yield payment measured at fair value through profit or loss | 34 | 2 844 | 263 |

Acquisition of intangible and tangible assets | 11.12 | (2 094) | (901) |

Disposal/derecognition of intangible and tangible assets | 11.12 | 53 | 33 |

Net cash flows from investing activities | (209 844) | (58 548) |

Description | Note | 31.12.2024 | 31.12.2023 |

FINANCIAL ACTIVITIES: |

|

|

|

Cash inflow from capital increase | 20 | 24 345 | 30 000 |

Lease payments | 12 | (549) | (500) |

Cash inflow from bond issuance | 18 | 619 883 | 1 699 777 |

Repayment of bonds issued | 18 | (527 710) | (304 142) |

Net cash flow from financial activities |

| 115 969 | 1 425 135 |

Net increase/decrease in cash and cash equivalents | (603 683) | 779 299 | |

Net foreign exchange difference | 184 | (14) | |

Cash and cash equivalents at the beginning of the year | 4 | 965 591 | 186 306 |

Cash and cash equivalents at the end of the year | 4 | 362 092 | 965 591 |

15 April 2025

Authorised for issue by

Kornél Kisgergely Sándor Ladányi

Chairman and Chief Executive Officer Chief Financial Officer

NOTE 1 GENERAL INFORMATION

Hungarian Export-Import Bank Private Limited Company ("Eximbank", "the Bank") was established on 26 May 1994 as one of the legal successors upon the dissolution of the Export Guarantee Corporation. The scope of Eximbank's activities and the specific provisions applicable to it are laid down in Act XLII of 1994, in force in Hungary (hereinafter: "Exim Act").

Eximbank's primary business goal is to promote Hungarian exports by granting loans and guarantees and to improve the international competitiveness of Hungarian businesses through domestic loans.

The Bank is a private limited company with its registered office in Hungary. The Bank's registered office: Nagymező u. 46-48., 1065 Budapest, Hungary.

The Minister for the National Economy exercises shareholder rights on behalf of the Hungarian State.

Eximbank is a specialised credit institution, wholly owned by the Hungarian State.

Under the Exim Act, Eximbank's mission is to finance the export of Hungarian goods and services, to finance domestic and foreign investments by Hungarian businesses, to finance investments related to Hungarian exports, and to provide financing for other purposes based on case-by-case decisions of the Government, thereby financing enterprises operating in Hungary - mainly small and medium-sized enterprises but also large corporations - in order to maximise export opportunities, contributing to the preservation and creation of jobs in Hungary and promoting the development of the national economy by improving the competitiveness of Hungarian exports in foreign markets.

In accordance with Eximbank's mission, it provides financing, guarantee and capital investment services to its customers and financial institution partners in order to fulfil its export-promotion duties. Within its scope of duties, it provides loans at favourable interest rates to export buyers in relation to sales of Hungarian exporters abroad, subject to OECD rules. The state's export credit agency functions are shared between Eximbank and Magyar Exporthitel Biztosító Zrt. (Hungarian Export Credit Insurance Ltd., "MEHIB."). While Eximbank is engaged in export, export-related financing and financing to improve international competitiveness - directly through lending or indirectly through venture capital and/or private equity funds - and offers guarantees for export and for domestic transactions, MEHIB provides export credit insurance to exporters or their banks, including Eximbank's borrowers as well.

The Bank's subsidiary:

The purpose of Exim Invest is to enforce the provisions of Government Decree 1512/2022 (X.24.) by establishing a capital fund structure in which, in the case of the vast majority of state-owned capital funds, the creation and termination of the capital fund and the exercise of investor rights in respect of directly or indirectly state-owned participation units are carried out under one single strategic management.

EXIM Invest Zrt., which is part of the structure of Nemzeti Tőkeholding Zrt., a public investment fund management company of the Ministry for National Economy, is responsible for the supervision and professional monitoring of domestic and internationally registered capital funds co-financed by Eximbank Zrt. One of the key areas of this activity relates to the recording of each investment fund in the financial statements of Eximbank as the Investor, whereby EXIM Invest Zrt. provides expert support to Eximbank in reviewing the investment valuation of the funds as part of the operational reports provided by the Fund Managers to the Investors on a regular basis. For several investment funds, value validation is carried out by engaging an external expert.

Exim Invest Zrt issued 5,000,000 shares, each with a nominal value of HUF 1 and an issue value of HUF 3. The shares included 4,999,999 A-series ordinary shares owned by Eximbank and 1 B-series preference share, which is now owned by Nemzeti Tőke Holding Zrt. (NTH). The volume/ratio of the Bank's shareholding and voting right is 99.99%.

Exim Invest began its actual operations in 2023, and therefore the Bank became subject to the obligation to prepare consolidated financial statements.

Exim Invest contributed HUF 57 million to the Bank's and subsidiary's after-tax profit, while the value of the services provided to the Bank was HUF 620 million, which was eliminated in accordance with the consolidation accounting methods described under section 3.17. Exim Invest did not pay any dividends in 2024.

The cash flow between the Bank and its subsidiary is the amount paid by the Bank as an advance payment for services of HUF 592 million.

Registered office of Exim Invest Zrt.: Kapás u. 6-12., 1065 Budapest, Hungary.

Other disclosures required by the Accounting Act:

- Home address of Kornél Kisgergely, Chairman and Chief Executive Officer: Budapest, Hungary

- Town/city of residence of Sándor Ladányi, Chief Financial Officer: Felsőzsolca, Hungary

- Details of the person responsible for controlling and managing accounting tasks:

o Name: Györgyi Szocska; mother's name: Valéria Tompa, ID number: 015671; registration number: MK181626; specialisation: IFRS for enterprises

- Eximbank website: https://exim.hu

There is a statutory obligation for Eximbank's financial statements to be audited. The audit fee for the current financial year was HUF 222 million + VAT. Business advisory services in an amount of HUF 44 million + VAT were provided by Ernst & Young Könyvvizsgáló Kft. in 2024.

Exim Invest's auditing fees for 2024 amounted to HUF 7 million.

NOTE 2 PRINCIPLES OF COMPILATION

IFRS compliance

These consolidated financial statements have been prepared in accordance with the International Financial Reporting Standards ("IFRS") adopted by the EU as well as the provisions of Act C of 2000 on Accounting, in force in Hungary, applicable to entities preparing their annual consolidated financial statements in accordance with IFRS.

IFRSs comprise accounting standards issued by the IASB and its predecessor body and interpretations issued by the International Financial Reporting Interpretations Committee ("IFRIC") and its predecessor body, as adopted by the EU.

The Bank has prepared separate financial statements in accordance with IFRS since 2019.

Pursuant to Section 177 (67) of Act C of 2000 on Accounting, Eximbank is required to mandatorily adopt EU IFRS standards in its separate financial statements for annual periods beginning from 1 January 2019, and is therefore required to apply EU IFRS standards to its consolidated financial statements.

Eximbank, as a parent company, is required to prepare a consolidated financial report from the 2023 business year onwards based on the nature of its participation in Exim Invest Zrt., as it has control over the relevant activities of the latter. Exim Invest Zrt issued 5 000 000 shares, each with a nominal value of HUF 1 and an issue value of HUF 3. The shares included 4 999 999 A-series ordinary shares owned by Eximbank and 1 B-series preference share, which is now owned by Nemzeti Tőke Holding Zrt. (NTH).

The Bank's consolidated and separate financial report are published on the same day. The accounting policies applied in the separate report do not differ from those applied in the consolidated annual statements, except that the subsidiary is integrated in the consolidated financial statements (see note 3.17.1).

Valuation principles

The consolidated financial statements have been prepared on a historical cost basis except for the following:

· Derivative financial instruments are measured at fair value,

· Non-derivative financial instruments measured at fair value through profit or loss are measured at fair value,

· Investments in equity instruments of entities over which the Bank has joint control or significant influence are measured using the equity method.

The preparation of financial statements requires the management to make certain judgements, estimates and assumptions that affect the reported amounts of assets, liabilities, income, expenses and disclosure of contingent assets and liabilities. Actual results may differ from these estimates.

Estimates and underlying assumptions must be reviewed on an ongoing basis. Revisions to accounting estimates are to be recognised in the period in which the estimate is revised and, if necessary, in any future periods affected by the revision.

In particular, information about significant areas of estimation uncertainty and critical judgements in applying accounting policies that have the most significant effect on the amount recognised in the financial statements are presented in Note 33.

Functional and presentation currency

The items in the consolidated financial statements are measured in Hungarian forint (functional currency), being the currency of the primary economic environment. Except as otherwise indicated, in the consolidated financial statements all financial information is presented in Hungarian forint (presentation currency), rounded to the nearest million.

NOTE 3 SIGNIFICANT ACCOUNTING POLICIES

Accounting policies are the set of principles, conventions, rules and practices applied by the Bank and its subsidiary in the preparation and presentation of its financial statements. The accounting policies set out below have been applied consistently to all periods presented in the consolidated financial statements.

The statement of financial position was prepared in liquidity order. A statement of assets and liabilities recovered or settled within twelve months following the date of presentation of the financial statements and during a period longer than the twelve months is included in Note 27.

Financial instruments

A financial asset or a financial liability is recognised in the statement of financial position when, and only when, under the contract the Bank and its subsidiary become a subject of the contractual provisions of the instrument.

The Bank and its subsidiary initially recognise their financial instruments on the settlement date, except for derivative financial instruments, which are recognised on the trade date.

Exim Invest presents its financial assets and liabilities consistently at amortised cost.

On initial recognition, the Bank measures financial instruments at fair value through profit or loss. On initial recognition, the Bank measures other financial assets and financial liabilities at fair value adjusted for directly related transaction costs. The fair value of a financial instrument at initial recognition is usually the transaction price.

On initial recognition, financial assets are classified into one of the following measurement categories:

· financial assets measured at amortised cost,

· financial assets measured at fair value through other comprehensive income (FVOCI)

· financial assets measured at fair value through profit or loss (FVTPL).

A financial asset is measured at amortised cost if it meets all of the following criteria and is not designated as measured at fair value through profit or loss:

· the asset is held in a business model whose objective is to collect contractual cash flows, and

· the contractual terms of the financial asset give rise on specified dates to cash flows that are solely payments of principal and interest (SPPI).

A financial asset is measured at fair value through other comprehensive income if it meets all of the following criteria and is not designated as measured at fair value through profit or loss:

· the asset is held in a business model whose objective is both to collect contractual cash flows and to sell financial assets, and

· the contractual terms of the financial asset give rise on specified dates to cash flows that are solely payments of principal and interest (SPPI).

The following table shows the result of the SPPI test:

Financial asset type | Result of SPPI test |

Loans eligible for interest equalisation | SPPI-type cash-flow characteristics |

NHP loans | SPPI-type cash-flow characteristics |

Aid credits | SPPI-type cash-flow characteristics |

Loans to employees | SPPI-type cash-flow characteristics |

Other (market rate) loans | SPPI-type cash-flow characteristics |

Government securities Corporate bonds | SPPI-type cash-flow characteristics SPPI-type cash-flow characteristics |

In the course of the analysis it was established that Eximbank has contractual rights to collect the unpaid amounts of the outstanding principal and its interests. There are no restrictions on contractual cash flows that are incompatible with the SPPI criteria. The cash flow, or a part of it, is not linked to the performance of the debtor or of any other related factor. Payments are not deferred regardless of interest accrual. There is no pre-defined condition in the contract that allows the non-repayment of any amount.

Eximbank's customers have access to loans at favourable interest rates ("net interest") under the interest equalisation system. These loans earn the Bank interest ("gross interest") based on the actual cost of funds, credit risk premium and operating premium of the assets. Part of the cash flow from loan transactions is from customers and other financial institutions ("net interest"), while the other part is from the central budget, according to the base cost calculated by the Bank. The difference between the 'gross' and 'net' interest income represents the interest equalisation due from the central budget.

The interest equalisation of a given contract is directly linked to the cash flow from customers. This means that interest equalisation ceases when the cash flow from the customer ceases. That is, there is no interest equalisation without the cash flows from the underlying customer loan. Under IAS 32, a financial asset is any asset that embodies a contractual right to receive cash or other financial asset from another entity. In light of this, for interest equalisation contracts, the individual financial instrument subject to the SPPI test is the entire loan agreement that contains not only cash flows payable by customers but also the interest equalisation element. The Bank has performed the SPPI test under IFRS 9 for contractual cash flows that include interest equalisation.

Loans granted under the interest equalisation facility are considered variable rate loans even if customers pay a fixed interest rate to the Bank. That is, the interest equalisation mechanism converts the fixed interest rate into a synthetic variable interest rate. A loan granted under an interest equalisation system is considered a regulated interest rate instrument according to the definition in IFRS 9 B4.1.9E, as interest equalisation is regulated by law and government regulation. A regulated interest on the Bank's loans granted under an interest equalisation facility is considered to be a component equivalent to the time value of money, as the regulated interest rate represents a consideration that approximates the passage of time and does not represent an exposure to risk or volatility in terms of the contractual cash flows that is inconsistent with a core loan agreement.

For interest equalisation loans, the Bank has established that the loan product involved in an interest equalisation facility has the same contractual characteristics as a core loan agreement and, accordingly, the most important element of interest in the loan transaction is the consideration for the time value of money and the credit risk value. The interest also provides cover for the Bank's operating costs, which may also be part of a core loan agreement. To comply with the SPPI test, these loans are measured at amortised cost.

For the purposes of the SPPI test under IFRS 9, the characteristics of aid credits are essentially the same as those of the interest equalisation products, except that the central budget compensates the Bank only up to the source cost, not up to the base cost. Consequently, the findings made for the valuation of interest equalisation loans under the SPPI are also valid for aid credits, since the contractual cash flows (principal payments and total interest) of aid credit transactions are similar to the cash flows (principal payment and total interest) of the loans subject to the presented interest equalisation, except to the extent compensated by the central budget.

A difference between aid credits and interest equalisation loans, in terms of the SPPI test, may be that in the case of aid credits, the central budget does not compensate for operating costs and the interest does not reflect the interest rate premium for credit risk. However, these differences do not affect assessment under the SPPI test, as

· for a core loan agreement defined under the IFRS 9 standard, the interest rate does not necessarily include an interest rate premium to compensate for operating costs; and

· aid credits are insured by MEHIB at the expense of the central budget, so there is no credit risk for the Bank.

Therefore, as with the interest equalisation loans, the Bank has not identified any contractual cash-flow characteristics for the aid credits that would be inconsistent with the requirements of IFRS 9 SPPI. The Bank evaluates aid credits at amortised cost.

Overall, the financial assets managed by the Bank are designed to manage the Bank's liquidity so that the Bank can meet the required liquidity ratios. Past experience shows that these assets typically are not resold, with the primary objective of each purchase being to collect interest and principal over the term.

The Exim Act expressly prohibits security transactions for trading purposes.

The Business department of the Bank deals with lending and guarantees. The purpose of lending is in all cases to collect the interest and principal during the term. The Bank will not originate any transactions where the original intention is to transfer the asset to another party at a later date, nor has it any previous experience of selling. If a receivable becomes irrecoverable, a dedicated department of the Bank will take over and collect the outstanding debt; only in exceptional cases may the receivable be sold.

The assessment of the performance of the employees and their compensation are not linked to the return on securities (either to the fair value of the securities or to the contractual cash flows collected).

Upon the initial recognition of an investment in an equity instrument not held for trading, the Bank may irrevocably elect to recognise changes in fair value in other comprehensive income. There is an option to make this election per instrument.

All other financial assets and financial liabilities are measured at fair value through profit or loss.

At initial recognition, the Bank classifies financial liabilities into the following measurement categories:

· financial liabilities measured at amortised cost

· financial liabilities measured at fair value through profit or loss (FVTPL).

At initial recognition, the Bank also recognises financial guarantee contracts and loan commitments (credit lines) below the market interest rate at fair value, with respect to the settlement date.

Derivatives are measured at fair value in the statement of financial position.

In cases when there is a reporting date between the date of the transaction and the settlement date, the Bank recognises the fair value difference between the transaction and reporting date in the case of financial instruments measured at fair value under Other assets or Other liabilities.

The Bank derecognises a financial asset when

· the contractual rights to the cash flows from the financial asset expire, or

· the Bank transfers the contractual rights to receive the cash flows of the financial asset, or the Bank retains the contractual rights to receive the cash flows of the financial asset, but assumes a contractual obligation to transfer the cash flows to one or more recipients in an arrangement that meets certain conditions, in a transaction in which

o the Bank transfers substantially all risks and rewards from the ownership of the asset, or

o the Bank does not transfer or retain substantially all the risks and rewards of ownership, and the Bank does not retain control of the financial asset.

Modification of contractual terms of financial assets and liabilities

In the case of modification of the contractual terms of financial assets or liabilities, the Bank assesses whether the modification is significant. If the modification is significant, the financial asset or liability is derecognised.

In the case of a substantial modification resulting in the derecognition of a financial asset or liability, the financial asset or liability ceases to exist, and a new financial asset or liability is recognised at fair value. Any difference between the derecognised carrying amount of the original financial asset or liability and the new financial asset or liability, recognised at fair value, is recognised in profit or loss.

Eligible transaction costs related to the new financial asset increase the fair value of the related financial asset. Income from fees related to modifications are presented as gain or loss on derecognition, except for fees that adjust the fair value of the new financial asset and fees that compensate transaction costs, which are taken into account at the initial recognition of the new financial asset.

If the modification is not deemed significant, the Bank recalculates the gross carrying amount of the financial asset or the amortised cost of the financial liability with the net present value of the modified future contractual cash flows discounted by the original effective interest rate (or, for financial assets purchased or originated with impaired credit quality, the effective interest rate adjusted for credit risk) and recognises the resulting gain or loss in profit or loss. In the case of instruments with variable interest rate, the original effective interest rate used to calculate the gain or loss is adjusted to reflect current market conditions prevailing at the date of the modification.

The costs or fees incurred, after accounting for the above difference, adjust the carrying amount of the financial asset or liability - gross value in the case of a financial asset - and are amortised over the remaining life of the instrument by recalculating the effective interest rate.

In order to determine whether a contract modification is significant, the Bank performs

- a quantitative, and

- a qualitative test.

A contract modification is substantial if it can be regarded as significant according to either of the above tests.

A contract modification is considered to be significant on the basis of the quantitative test, if the present value of the contractual cash flows to be modified, discounted at the original effective interest rate, differs by at least 10% at the date of the modification compared to the gross carrying amount before the modification.

If, in the event of financial difficulty of the debtor, the Bank plans to modify the financial asset in such a way that it would result in a remission of cash flows, it first considers whether a part of the instrument should be written off before the modification. This has an impact on the quantitative test, as it may result in the conditions for derecognition not being met.

A contract modification is considered to be significant on the basis of the qualitative test if the Bank concludes that the risks of the modified financial asset or liability are substantially different from those of the original financial asset or liability.

In particular, a contract modification is considered significant in the following cases:

- change in currency

- fundamental change in the nature (type) of the asset or liability

- change if interest rate from fixed to variable (or from variable to fixed) the change results in the modified cash flows not meeting the SPPI test

The Bank and its subsidiary derecognise a financial liability (or a part of it) in the financial statements when it is extinguished - i.e. when the obligation set out in the contract is discharged or cancelled or it expires.

Financial assets and financial liabilities recognised in the statement of financial position are offset and the net amount is shown when the Bank or its subsidiary has a legally enforceable right to offset the amounts and it intends either to settle them on a net basis or to realise the asset and settle the liability simultaneously.

Financial instruments measured at fair value (derivatives)

The Bank measures its derivative financial assets and liabilities at fair value through profit or loss.

For economic hedging purposes, the Bank may enter into contracts for derivative financial instruments (swaps, IRS, CCIRS), and in doing so it may, of business reasons, choose to apply hedge accounting under IFRS 9. All derivative financial instruments are carried at fair value, and all gains and losses realised on these instruments are recognised under "Gains and losses from trading and investment activities" in the profit and loss account. The details regarding hedge accounting can be found in Note 5.

Investments measured t fair value, and investments accounted for using the equity method

A part of the Bank's capital investments consists of investments in investment funds, which are designed to generate yields and also to leverage banking relationships. The majority of capital investments is in the form of interest in investment funds.

Investments in equity instruments of associates and joint ventures where the Bank has joint control or a significant influence are accounted for using the equity method (see Note 3.17).

Since these investments do not meet the criteria of the SPPI (see Note 3.1), all other investments are measured at fair value through profit or loss.

Dividend income (except where the dividend is clearly intended to recover the cost of an investment) at the date of approval and other gains/losses on investment fund shares are recorded under "Gains or losses from trading and investment activities" at the time of the decision.

Financial instruments measured at amortised cost

Interest income on financial assets measured at amortised cost is calculated using the effective interest method.

When calculating the effective interest rate, the Bank estimates future cash flows considering all contractual terms of the financial asset but - with the exception of financial assets purchased or originated with impaired credit quality - does not take into account expected credit losses (ECL). For financial assets purchased or originated with impaired credit quality, the effective interest rate adjusted for credit risk is calculated using estimated future cash flows that include expected credit losses.

The calculation includes all amounts paid or received that are an integral part of the effective interest rate, including transaction costs, fees, premiums and discounts. Transaction costs include additional costs that are directly attributable to the acquisition or issue of a financial asset or liability.

After initial recognition financial liabilities are measured at amortised cost, except for derivative financial liabilities.

Cash and cash equivalents

Cash and cash equivalents include banknotes and coins, balances held with central banks and highly liquid financial assets with a maturity of less than three months, which are subject to insignificant risk of changes in their fair value, and are held by the Bank in order to settle short-term commitments. After initial recognition the Bank and its subsidiary measure these instruments at amortised cost in the statement of financial position.

Securities measured at amortised cost (government securities and corporate bonds)

The Bank measures debt securities that meet the SPPI criteria and are held in order to collect principal and interest cash flows at amortised cost in the statement of financial position, following initial recognition.

Receivables from credit institutions and insurance companies and Receivables from other customers

The Bank measures loans to banks, insurance companies and other customers, which meet the SPPI criteria and are granted in order to collect principal and interest cash flows, at amortised cost in the statement of financial position, following initial recognition.

Liabilities to credit institutions and insurance companies, and Liabilities to other customers

Loans and deposits from banks and insurance companies, receivables from other customers and debt securities issued are carried after the initial recognition at amortised cost.

Financial guarantees and loan commitments (credit lines)

A financial guarantee is a contract that requires the Bank to make specified payments to reimburse the holder for losses it incurs because a specified debtor has failed to make payment when due in accordance with the terms of the debt instrument.

A loan commitment is a firm commitment to provide a loan on pre-determined terms.

In the normal course of business, the Bank issues financial guarantees, which consist of letters of credit and loan guarantees. Financial guarantees and commitments to provide loans at market interest rates are measured at fair value on initial recognition and are presented in the statement of financial position under "Other liabilities". The fair value of financial guarantees is the fee for the guarantee received. In the subsequent valuation, the Bank as the issuer of the guarantee will value it at the higher of:

(i) the amount of the loss allowance determined in accordance with IFRS 9, or

(ii) the amount initially recognised less the amount of deferred income recognised in accordance with the principles of IFRS 15.

The premium received is recognised on a straight-line basis over the life of the guarantee in the profit and loss account under "Fee and commission income".

The provision for losses on financial guarantees and loan commitments is presented in the statement of financial position under "Provisions" while in the statement of comprehensive income it is recognised under in "Impairment losses on financial instruments and (creation)/reversal of provisions".

Determination of fair values

Several provisions of the Bank's accounting policies and their annexes require the determination of fair value for financial assets and liabilities. Fair values are determined for measurement and/or disclosure purposes based on the following methods.

Fair value is the price that would be received for selling an asset or transferring a liability in an arm's length transaction between market participants at the measurement date under current conditions in the primary market for the asset or liability or, in the absence of such, in the most favourable market. The fair value of a liability reflects the Bank's non-performance risk.

All financial instruments are recognised initially at fair value. In the normal course of business, the cost of a financial instrument at initial recognition is the transaction price (that is, the fair value of the consideration given or received). In case the initial fair value differs from the transaction price, the Bank recognises the initial (first-day) fair value difference between the fair value and the transaction price as follows. If the fair value measurement is supported by a price quoted in an active market for the same asset or liability or is based on a measurement method using only observable market prices, the Bank recognises the difference in profit or loss. Otherwise the Bank adjusts the carrying amount of the financial instrument to defer the recognition of the difference and recognises it in profit or loss to the extent that it arises from changes in the factors that market participants consider in pricing the instrument.

The fair value of financial instruments quoted in active markets is measured at the (unadjusted) prices quoted in active markets, on the basis of bid prices for assets and ask prices for liabilities (level 1).

If no directly or indirectly observable prices quoted in an active market are available, fair value is determined using valuation techniques that use inputs other than observable market prices. These include the use of quoted prices of similar instruments in active markets, quoted prices of identical or similar instruments in markets that are not active, or the use of other valuation techniques in which all significant inputs originate directly or indirectly from market data. (Level 2).

In all other cases, financial instruments are measured using valuation techniques that use unobservable inputs, and these have a significant effect on the valuation of the instrument (level 3). This includes valuations based on quoted prices for similar instruments that require significant unobservable adjustments or assumptions in order to reflect differences between the instruments. See Note 34 for further details of fair value determination.

Impairment on financial assets

The Bank recognises a loss allowance for expected credit losses on the following financial instruments:

· financial instruments classified as debt instruments;

· lease receivables;

· financial guarantee contracts issued;

· loan commitments (credit lines).

Investments in equity instruments measured at fair value through profit or loss or other comprehensive income are not impaired in accordance with IFRS 9.

The Bank measures the loss allowance at an amount equal to the expected credit loss over the lifetime of the loan, except for the following, for which measurement is at the amount of the 12-month expected credit loss:

· debt securities that, as determined by the Bank, have a low credit risk at the reporting date;

· other financial instruments (except for lease receivables), for which credit risk has not increased significantly since initial recognition.

In the case of lease receivables, loss allowance is always measured at an amount equal to the expected credit loss over the lifetime of the lease.

The 12-month expected credit loss is the portion of the credit loss expected over the lifetime of the instrument that embodies the expected credit loss that may be incurred during the 12 months after the reporting date as a result of a default event concerning the financial instrument.

The lifetime expected credit loss is the expected credit loss arising from all possible events of default during the expected life of the financial instrument.

The expected credit loss is the probability-weighted average of credit losses.

At each valuation date, the Bank classifies the financial instruments into Stages, and determines the expected credit loss to calculate loss allowance, as described above. In accordance with the above, financial instruments are classified into three categories:

· Stage 1 classification is applied to financial instruments at initial recognition, except for POCI (purchased or originated credit impaired) receivables. Financial instruments remain in Stage 1 until a significant deterioration of credit risk compared to initial recognition occurs. This Stage also includes financial instruments that the Bank considers to be low credit risk at the reporting date. For Stage 1 instruments, the Bank calculates a 12-month expected loss using lifetime PD (probability of default) models and LGD (loss given default) values, elaborated by segment; in the case of off-balance sheet items, it uses CCFs (credit conversion factors), reflecting the probability of inclusion in the balance sheet.

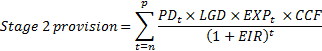

· Stage 2 classification is applied to financial instruments where a significant increase of credit risk can be observed since initial recognition, however, the criteria for non-performing (default)/credit impaired exposure are not met. Lifetime expected losses are calculated for instruments included in Stage 2 using future exposures derived from contractual cash flows, the corresponding lifetime PD models, LGDs, as well as CCFs for off-balance sheet exposures.

· Stage 3 classification is applied to default / credit impaired financial instruments. The Bank uses the NPL (non-performing loan) definition of the MNB (National Bank of Hungary), and also applies the concept of "default" in accordance with Article 178 of Regulation (EU) No 575/2013 of the European Parliament and of the Council on prudential requirements for credit institutions and investment firms (CRR) with the same content. The Bank evaluates all Stage 3 financial instruments individually, using probability-weighted cash flow scenarios discounted by the effective interest rate.

The Bank applies different credit risk models and parameters for each portfolio segment. The evaluation of Stage 1 and Stage 2 financial instruments are underpinned by PD models and LGD parameters developed for the following portfolio segments:

· Corporate;

· Sovereign/sub-sovereign;

· Domestic financial institutions;

· Foreign financial institutions.

The Bank has developed its lifetime expected probability of default (lifetime PD) models by analysing and forecasting historical empirical default rate timelines from external sources, as a function of time from initial recognition (vintage approach), using default rates published by Standard&Poor's and Weibull curves. All lifetime PD curves of all segments, developed along international ratings, have been mapped to the Bank's internal 7-grade rating classes. The Bank uses conditional PDs to estimate the expected probability of default. The model change in 2024 had no material impact on the magnitude of expected loss for financial instruments.

The Bank performs PD correction on the corporate lifetime PD model by applying the forward-looking ARMAX (auto regressive moving average eXogeneous, autoregressive moving average with external explanatory variables) macroeconomic model in accordance with MNB regulations. The macro model was revised in 2024. The model design represents an ARMA (1,0) model incorporating external explanatory variables. The autoregressive (AR) expresses the own previous value of the time series; the moving average (MA) expressing the estimation error of the previous period was dropped from the model in the 2024 revision. The source of historical actual data series of explanatory variables was the database of Central Statistical Office (KSH) and MNB. To make default rate forecast, the Bank used the most up-to-data available macroeconomic forecasts disclosed in the MNB Inflation Report. The R-squared ratio showing model fit was 76.1%. All parameters and the whole model were significant. The stationarity of model variables met all statistical application assumptions, the variables passed the multicollinearity and autocorrelation tests. The macro modelling methodology has remained basically unchanged since the transition to IFRS. In order to estimate the macro multiplier, which is brought up to date quarterly, the Bank continuously updated the available factual data.

When estimating corporate PDs in a forward-looking manner, the Bank uses the macroeconomic forecasts published in the MNB Inflation Report and the corporate default rate time series published in the MNB Stability Report. Taking into account the autoregressive term expressing the previous value of the time series, the six-quarter lag of the investment rate in the MNB Inflation Report, as well as the two- and three-quarter forward-looking values of the change in inflation rate in the MNB Inflation Report, the Bank has constructed a macro model used for the PD adjustment. In view of the fact that IFRS 9 requires the Bank to take into account its expectations of the macroeconomic environment in an unbiased manner in the expected loss calculation, and given that the relationship between macroeconomic indicators and the development of expected loss is not linear in practice (a certain amount of macroeconomic shock may have a larger impact on loss than an equal positive shock), the Bank has based its unbiased estimate used as a basis for forward-looking expectations on a probability-weighted average of three scenarios. The weights of the scenarios have been developed by the Bank in accordance with the MNB's Executive Circular on the use of macroeconomic information and factors indicating a significant increase in credit risk for the purposes of IFRS-9. The baseline scenario, similarly to 2023, was included in the estimate with a weight of 60%, the optimistic scenario with a weight of 10%, and the pessimistic scenario with a weight of 30%.

In Q4 2024, updated with the most recent macroeconomic forecasts, the Bank projected the corporate default rate until 31 December 2026 using the macro model, with a quarterly frequency. The Bank used the facts and forecasts set out in the MNB Inflation Report.

Investment volume index is defined by KSH as the annual index of gross accumulation of fixed assets. With regard to the indicator, using the values published in the annex to the latest MNB IFRS-9 Executive Circular, the Bank assumed that, based on the latest factual data of 2023, which were extremely unfavourable at -7.4%, and based on the MNB's expectations for 2024, and applying linear interpolation, it would result in 3.0% in the baseline scenario for both 2025 and 2026, and -8.6% and 4.4% in the pessimistic scenario, for 2025 and 2026 respectively, while in the optimistic scenario it would improve to 9.8% and 2.3%.

The inflation rate for a given year/year corresponds to the consumer price index (CPI), for which factual data are available from the HCSO. With regard to the inflation rate, the Bank assumed, using the values published in the annex to the latest MNB IFRS-9 Executive Circular, that based on the latest factual data and applying linear interpolation, it would reach 3.2% in the baseline scenario in 2025 and 3.0% in 2026, it would realise 2.8% and 2.9% respectively in the pessimistic scenario, while in the optimistic scenario it would be 3.4% and 3.1%, respectively.

In the corporate segment, the Bank uses LGD modelled on internal data using the collection LGD methodology in a vintage approach to determine expected loss. In the sovereign/sub-sovereign segment, the Bank applies a (Moody's) benchmark LGD backed by an external study, whereas in the case of financial institutions, the Bank applies a discounted return-based LGD, supported by data collected by Global Credit Data covering a wide range of non-performing banks. The external benchmark study looked at the non-performing transactions of 1,483 financial institutions around the world. The results showed an overall recovery rate of 72% using the workout LGD method, as a result of which a 28% LGD was applied for the Bank.

Given that the very low number of items in terms of historical data does not allow for CCF modelling on internal data, the Bank applies CCFs in line with the supervisory parameters published in the CRR. In 2024 the Bank switched to the CCF parameters under CRR3. The previously applied uniform CCF of 50% (except 20% for binding offers and contracts not yet in force) has been replaced by a CCF of 20% for non credit substitute guarantees, 40% for credit lines, binding offers and contracts not yet in force, and a CCF of 100% for credit substitute guarantees. The impact of the parameter change during the year reduced the provisions by HUF 95 million, which cannot be considered material.

In 2024, the Bank continuously applied management overlay impairment, which is a lump sum expected loss determined by the Bank on the basis of risk factors that are not or are not fully covered by the risk models it uses, making the impact of these risks not adequately quantifiable by running the models on a bottom-up basis. The Bank applies a top-down model with a management overlay adjustment differentiated by sector groups to determine the expected loss for the corporate segment. The Bank considers the management overlay to be significant at the reporting date of 2024 of the annual report, amounting to HUF 3,547 million.

The in-depth disclosure of formulae used to determine expected losses can be found in Note 30.

For all instruments, the Bank considers the following indicators to be significant deterioration in credit risk and accordingly classifies the transactions concerned as Stage 2:

· 30+ days past due, unless the delay is proven to be due to a technical error.

· A significant deterioration of the rating compared to the initial rating class. On its 7-point customer rating scale, the Bank considers a deterioration of 2 categories for rating categories 1 to 3 and 1 category for rating categories 4, 5 and 6 to be significant. Based on the option provided for in Section 5.5.10 of IFRS 9, the Bank makes use of the low credit risk rating option in the investment-grade sovereign and financial institution segment, according to which a deterioration from initial category 1 to category 3 does not entail a Stage 2 reclassification.

· Loans placed in performing, restructured status, including restructured status due to a moratorium period of more than 9 months.

· Transactions of a customer subject to liquidation.

The Bank applies low credit risk (LCR) limits for exposures with a BBB- or better investment grade rating for the sovereign and banking segments, but does not use LCR limits for corporate exposures. At the same time, the Bank sets stricter criteria for significant credit deterioration in certain lower-rated categories. Accordingly, in its internal rating system the Bank considers even a downgrade of 1 grade regarding transactions of customers with an initial rating of 4 or lower to be a significant deterioration in credit risk.

In addition, the Bank also uses the following EWIs (Early Warning Indicators) for domestic direct corporate exposures to determine significant credit risk deterioration:

· Based on a Central Credit Information System (KHR) query, the following may be determined in the case of loans at other credit providers:

- taking out a new loan, if the new commitment threatens the operation of the company,

- taking out a new loan, if it jeopardises the repayment of the loan(s) provided by the Bank, i.e. the debt service of the existing loan,

- default status of an existing loan (date, amount, whether it is settled or not),

- debt service details of an existing loan.

· Changes that have occurred in the debtor's data, especially for changes where the customer is required to notify and hand over related documents:

- there is a new owner (inspection and knowledge of the new owner is expected; in the case of an unfavourable change, the transaction must be classified as Stage 2),

- change of registered office (the check must cover whether the change is of a technical nature. If it indicates transfer and/or expected liquidation, the transaction must be classified as Stage 2),

- change of company registration number (the check must cover whether the change is of a technical nature. If it indicates transfer and/or expected liquidation, the transaction must be classified as Stage 2),

- change of tax number (the check must also cover whether the change is of a technical nature. If it indicates transfer and/or expected liquidation, the transaction must be classified as Stage 2).

· Unfavourable decline of account turnover and/or customer base negatively affecting debt service. If significant, the transaction must be classified as Stage 2.

· A change in the company's main scope of activity and the cash flow resulting from this are not sufficient to service the debt.

· A significant decline in the debtor company's equity. Reclassification to Stage 2 should be considered if the equity decreases by at least 25%, or the capital adequacy (equity/total assets) decreases by at least 10% compared to the data in the audited annual report at the end of the previous year.

· A significant change, i.e. decline in the number of the debtor company's employees. It is necessary to check what is causing this process. If a transfer to another company is indicated, the transaction must be classified as Stage 2.

· Enforcement is initiated against the company (e.g. National Tax and Customs Administration (NAV) or independent court bailiff). The transaction must be classified as Stage 2 if the enforcement is classed as significant.

The enforcement is significant if

- enforcement has been initiated more than 3 times in the last 12 months or

- in the last 12 months, an enforcement was in process that had not been settled within 30 days

(That is, if at the time of the investigation there is an unsettled enforcement in process that was launched within the last 30 days, this does not yet mean an enforcement of significant scale.)

· In the case of a non-real estate financing project loan, the project is not or is not fully realised and/or cannot generate the debt servicing requirement.

· Non-payment of insurance premium (30+ days past due or contract becomes inactive).

· A negative change in coverage level, which refers to a significant, unfavourable change in the economic entity's solvency (significant depreciation in the value of productive assets) or in its willingness to pay (withdrawal of coverage).A reduction of at least 15 percentage points in the coverage ratio compared to the last decision is classed as significant.

· A breach of contractual commitments and covenants, as a result of which the profitability of the given transaction may be in jeopardy.

· Deterioration of data provision discipline - a delay in customer, transaction and collateral-related data provision by the customer. In the case of regular delays, the transaction must be classified as Stage 2.

· A change in legislation that negatively affects the business of the customer, which threatens the financial stability of the customer.

· Significant negative information affecting the customer, the customer group, its partners or industry.

· A significant adverse change in the sectoral outlook that threatens the financial stability of the customer.

· A negative change in the majority of financial indicators calculated during regular rating. The indicators to be examined are set out in detail in the Bank's Monitoring regulations.

In addition, the Bank also uses the following EWIs for real estate project loans to determine significant credit risk deterioration:

· LTV rises above 1 (except: construction phase).

· The DSCR or projected debt service coverage ratio (PDSCR) calculated on the basis of the periodic (annual) generated and non-cumulative cash flow falls below 1.05.

· The construction phase is delayed by more than 1 year compared to the original plans.

· There is a modification in the terms of the project financing transaction (either through modification of the original contract or refinancing), which results in an overall increase in risk for the Bank in the assessment of the transaction.

· The original budget of the project set in the loan agreement increases to a level that cannot be matched by the rate of increase in market value, and the cost increase is accompanied by an increase in the project's/debtor's financing needs, and the risk parameters of the increased loan (including LTV, DSCR, interest coverage, balloon/bullet rate, full repayment period) indicate an increased level of risk compared to the original approval.

The Bank introduced cross-staging in 2024, in line with the requirements of the MNB IFRS-9 Methodology Manual to be issued. Accordingly, if any transaction of a customer has been reclassified to Stage2, the other transactions of the same customer previously classified as Stage1 have also been reclassified to Stage2. The change in classification methodology during the year resulted in the creation of a provision of HUF 34 million, which the Bank does not consider material.

A reclassification from Stage 2 to Stage 1 may be made if none of the criteria for a significant deterioration of credit risk can be observed at the assessment date. See Note 30 for the quantitative disclosure of Stage 2 items and impairment that have the characteristics of significant credit risk deterioration.

Pursuant to Article 178 of the CRR, the provisions of MNB Decree 39/2016 and the MNB Recommendation 9/2022, transactions are considered non-performing (default) or of impaired creditworthiness, and are classified in Stage 3, where:

· The duration of the delay shall be a continuous delay of at least 90 consecutive days, if the delayed portion is significant. This condition cannot be disregarded even on the basis of an expert assessment. The Bank has set the materiality threshold at EUR 500.

· Based on an assessment of the debtor's financial situation, it can be assumed that without recourse to the collateral, the debtor will not be able to repay the full amount of its obligations (regardless of whether the claim is past due).

Risk-of-default factors:

- there are well-founded concerns regarding the debtor's ability to generate stable and satisfactory cash flows in the future,

- in the case of working capital loans, it is unable to pay the interest from its EBITDA,

- in the case of investment loans, the customer is unable to pay even the annual principal and interest repayments from its EBITDA less the amount of the estimated tax,

- the debtor no longer has regular sources of income to meet its repayments,

- the debtor's overall leverage has increased significantly, or there are reasonable grounds to believe that such a change in leverage will occur,

- the debtor has breached its contractual obligations,

- fraud committed in connection with the contract,

- the Bank has drawn on any of the collateral, including exercising a guarantee,

- in the case of exposures to a private individual: the non-performance of a company 100% owned by a single individual, where that individual has given a personal guarantee to the Bank in respect of all the obligations of the company,

- a crisis affecting the sector in which the debtor operates, combined with a weak position on the part of the debtor in that sector,

- the disappearance of an active market for a financial asset due to the financial difficulties of the customer,

- the Bank has information that a third party - especially another institution - has initiated the liquidation of the debtor or a similar measure (e.g. enforcement, compulsory strike-off, order for the criminal attachment of the debtor's assets).

· Exposures for which an individual loss allowance has been recognised, excluding the loss allowance recognised collectively for transactions classified as Stage 1 and Stage 2 under IFRS-9.

· All exposures against a customer, if an individual loss allowance has been recognised for any of the customer's transactions, excluding the loss allowance recognised collectively for transactions classified as Stage 1 and Stage 2 under IFRS-9.

· The Bank has initiated a liquidation or distraint procedure to collect the customer's debt.

· The customer has initiated a liquidation or bankruptcy proceedings against itself in order to avoid or postpone the discharge of its obligations to the Bank.

· The customer has initiated a reorganisation procedure.

· The bank guarantee issued by the Bank has been drawn down or is expected to be drawn down.

· An off-balance sheet liability that is likely to be drawn on, and whose drawing or other use will result in an exposure that is at risk of not being fully recovered without the enforcement of collateral.

· The loan agreement has been terminated.

· Deals that have gone under Workout handling or become subject to legal proceedings (liquidation, bankruptcy, distraint initiated by the Bank).

· Restructuring that results in a significant reduction of financial liabilities for the customer.

The Bank does not examine the significant deterioration of credit risk in the case of POCI receivables. In each case, POCI receivables are classified in Stage 3 and assessed individually.

The accounting policy for financial guarantees and loan commitments is set out in chapter 3.5 and the policy (formulae) for the calculation of loss allowance is set out in Note 30.

Reversal of loss allowance

If the loss allowance is reversed in the next period, it is recognised through profit or loss.

Write-off of loans and advances

Uncollectible receivables are written off against the related loss allowance if the reasons for assigning them to uncollectible status as specified in the Workout policy apply, or if there is no reasonable expectation of recovery. The Bank recognises any subsequent recoveries of receivables previously classified as uncollectible in profit or loss. The Bank may also write off part of the receivable if the full recovery cannot be reasonably expected, but the Bank still intends to fully recover the partially written-off receivables. Partial or full write-off of the receivables is possible at least three years after the occurrence of the default event, if an individual assessment shows that any repayment of the debt from future cashflows of the debtor is unlikely, and if an appropriate asset-distribution pan is available from the liquidator.

Restructured loans

The Bank first attempts to restructure loans in cooperation with the debtors, rather than taking legal action to recover the debt. This may include extending the term, changing the payment schedule or revising the terms of the loan. In the event of restructuring, the Bank examines whether the contract amendment is significant in accordance with Note 3.1 and, as a result, shall determine a restructured rating of "performing" or "non-performing" and shall apply the 10% rule to determine the derecognition criterion. Following a restructuring, the Bank determines the impairment using the original EIR as it was the case before the terms were modified, regardless of the fact that the loan is no longer past due. Management monitors the fulfilment of the conditions of restructured loans on an ongoing basis to ensure that the required criteria are met, that future payments are made and that the criteria for derecognition are fulfilled. The Bank classifies non-performing restructured loans in all cases into Stage 3, and calculates the impairment by discounting the cash flows by the original EIR.

General reserve

The provisions of the Act CCXXXVII of 2013 on Credit Institutions and Financial Enterprises ("Credit Institutions Act") require the Bank to establish a general reserve of 10% of its profit after tax for the year to cover future losses. Based on the decision of the management and the approval of the Owner, the Bank transfers the after-tax profit for the given period (after the establishment of the mandatory 10% reserve) from retained earnings to the general reserve. As this decision relating to the given financial year is made by the Owner in the following financial year, the after-tax profit for that period is reallocated in the year of the decision.

Based on the owner's decision, the Bank places 100% of its annual after-tax profit in retained earnings, after which the amount placed in retained earnings is placed in the general reserve. In the case of a loss, based on the Owner's decision the amount of the accumulated general reserve will be used.

Foreign currency translation

The primary (functional) currency of the Bank and its subsidiary is the Hungarian forint. Revenues and expenses arising in foreign currency are translated into the functional currency at the exchange rates valid on the date of the transaction.

Monetary assets and liabilities denominated in foreign currencies are revalued at rates quoted by the National Bank of Hungary ("MNB") at the reporting date, with resulting revaluation differences being recognised in profit or loss.

Non-monetary assets and liabilities denominated in foreign currencies that are measured at fair value are translated to the functional currency at the exchange rate at the date when the fair value was determined. Non-monetary items denominated in foreign currency that are measured at historical cost are retranslated to the functional currency at the exchange rate valid on the date of the transaction. Foreign exchange differences arising upon revaluation are recognised in profit or loss under "Gains or losses from trading and investment activities".

In the case of investments in foreign currency accounted for using the equity method, the exchange rate difference between the presentation currency of the foreign holding and the functional currency of the Bank is recognised by the Bank in other comprehensive income.

Intangible and tangible assets

Intangible assets, property, as well as plant and equipment are measured at cost less accumulated depreciation and accumulated impairment.

Cost includes expenditures that are directly attributable to the acquisition of the asset. In the case of property, plant and equipment, the cost of maintenance and repair is recognised in profit or loss. Major refurbishments of property, plant and equipment and the cost of replacing a part of an asset are recognised in the carrying amount of the item concerned when it is probable that future economic benefits associated with the asset will be received by the Bank or its subsidiary and such can be measured reliably. The value of the replaced components is derecognised.

Depreciation is calculated on a straight-line basis over the estimated useful lives of the assets, using the following rates, which may vary based on specific information

Renovation carried out on a leased property based on the duration of the lease

Software 3 years

Furniture, fixtures and office equipment 3-7 years

Depreciation methods, useful lives and residual values are reviewed at the end of each financial year and adjusted if appropriate.

Intangible assets, property, plant and equipment are subject to an impairment review if an event or change occurs that indicates that the carrying amount is above the recoverable amount of the asset.

The gain or loss on the derecognition of intangible assets, property, plant and equipment is determined as the difference between the proceeds from the sale and the carrying amount of the assets and is recognised in profit or loss under "Other operating expenses" or "Other operating income".

Leases

The lessee recognises a right to use the asset concerning the related asset and a lease liability for the obligations related to the lease. The lessor distinguishes between operating and finance leases.

The Bank monitors all its lease contracts in which it is a lessee on an ongoing basis and identifies those that contain a lease transaction under IFRS 16. In this regard, it recognises a right-of-use asset and a lease liability in respect of the leasing transactions. The initial recognition of the right-of-use asset is at cost while lease liabilities which were classified as operating leases according to IAS 17 are recognised at the present value of the outstanding lease payments. Items taken into consideration when calculating the cost of an asset:

- the initial value of the liability

- use premiums paid at the start of the term (or before)

- any initial direct costs incurred by the Bank

- lease incentives received as cost decreasing elements

- estimated costs for dismantling, removing and restoring the asset